Preparing National Income Accounting (also known as National and Related Aggregates) for the Class 12 Economics exam can be challenging, but important questions (including numerical problems) can help you feel more confident and prepared. Here, you'll find a variety of exam-style questions and answers to help you test your knowledge and improve your understanding of this important topic.

| Board | CBSE and State Boards |

| Class | 12 |

| Subject | Economics |

| Book Name | Macroeconomics |

| Chapter No. | 2 |

| Chapter Name | National Income and Related Aggregates (National Income Accounting) |

| Type | Important Questions and Answers (Including Numericals) |

| Weightage | 10 marks |

National Income Accounting Class 12 Questions and Answers (with Numericals)

Q. No. 1) Multiple Choice Questions (MCQs)

i. Inventory is a _____ concept whereas the change in inventory is a _____ concept.

a. stock, flow

b. flow, stock

c. stock, stock

d. flow, flow

Ans. Option (a)

ii. Read the following statements carefully:

Statement 1 – Net investment is a stock concept.

Statement 2 – Capital is a flow concept.

In the light of the given statements, choose the correct alternative from the following:

a. Statement 1 is true and statement 2 is false

b. Statement 1 is false and statement 2 is true

c. Both statements 1 and 2 are true

d. Both statements 1 and 2 are false

Ans. Option (d)

iii. Flow of Goods & services and factors of production across different sectors in a barter economy is known as _____.

a. Circular flow

b. Real flow

c. Monetary flow

d. Capital flow

Ans. Option (b)

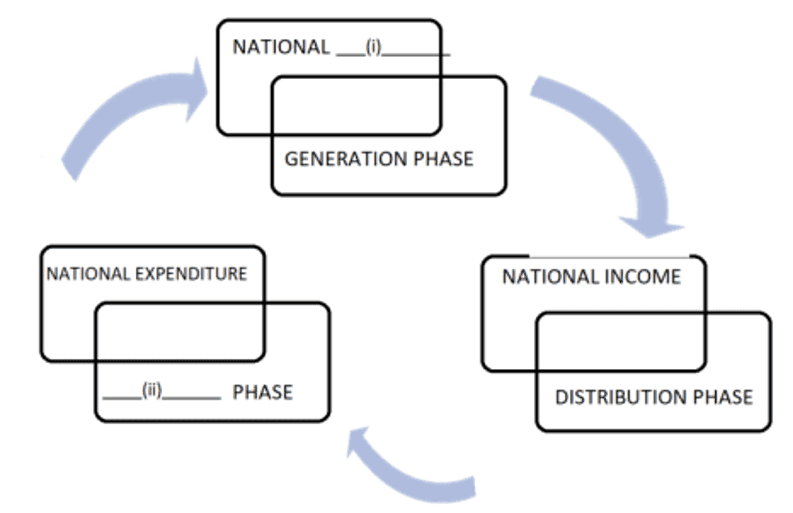

iv. Read the following figure carefully and choose the correct pair from the alternatives given below:

a. Output, production

b. Value added, production

c. Output, disposition

d. Wealth, development

Ans. Option (c)

v. If in an economy the value of Net Factor Income from Abroad is Rs. 200 crores and the value of Factor Income to Abroad is Rs. 40 crores. Identify the value of Factor Income from Abroad.

a. Rs. 200 crores

b. Rs. 160 crores

c. Rs. 240 crores

d. Rs. 180 crores

Ans. Option (c)

vi. For a closed economy (with no foreign trade), which one of the following is correct?

a. GDP = GNP

b. GDP > GNP

c. GDP < GNP

d. GDP + GNP = 0

Ans. Option (a)

Must See: National Income Accounting MCQs

Q. No. 2) Distinguish between Final Goods and Intermediate Goods.

Ans.

| Final Goods | Intermediate Goods |

| 1. Goods that are used either for final consumption by consumers or for investment by producers are known as final goods. | 1. Intermediate goods are those goods that are meant either for reprocessing or for resale. |

| 2. Its value is included in the national income. | 2. Its value is not included in the national income. |

Q. No. 3) State with a valid reason, which of the following statement is true or false:

a. Gross Value Added at market price and Gross Domestic Product at market price are one and the same thing.

b. Intermediate goods are always durable in nature.

Ans. a. The given statement is false as GDP is the result of the sum of Gross Value Added by all the producing units/firms in an economy, during an accounting year.

b. The given statement is false as intermediate goods are generally non-durable in nature. They are the goods used as raw materials and they lose their identity in the production process for the creation of a new commodity, during an accounting year.

Q. No. 4) Define nominal flow.

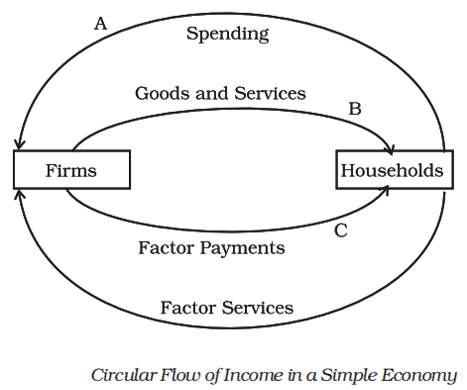

Ans. Nominal flow/Money flow is the flow of factor payments and payments for goods and services between households and firms. [Note: Real flow is the flow of factor services and goods and services between households and firms.]

Q. No. 5) Discuss briefly, the circular flow of income in a two-sector economy with the help of a suitable diagram.

Ans.

Circular flow of income in a two-sector economy – Households are owners of factors of production, they provide factor services to the firms (producing units). Firms provide factor payments in exchange for their factor services. So, factor payments flow from firms (producing units) to households.

Households purchase goods and services from firms (producing units) for which they make payments to them. So, consumption expenditure (spending on goods and services) flows from households to firms.

Q. No. 6) ‘Circular flow of income in a two-sector economy is based on the axiom that one’s expenditure is the other’s income’.

Do you agree with the given statement? Support your answer with valid reasons.

Ans. Yes, the given statement is correct. In a two-sector economy, the firms produce goods and services and make factors payments to the households. The factor income earned by the households will be used to buy the goods and services which would be equal to the income of firms. The aggregate consumption expenditure by the households in the economy is equal to the aggregate expenditure on goods and services produced by the firms in the economy (income of the producers).

Q. No. 7) a. ‘Domestic/household services performed by a woman may not be considered as an economic activity’. Defend or refute the given statement with a valid reason.

b. ‘Compensation to the victims of a cyclone is an example of a welfare measure taken by the government’. State with a valid reason, should it be included/not included in the estimation of the national income of India.

Ans. a. The given statement is defended, as it is difficult to measure the monetary value of the services performed by a woman (homemaker). Therefore, these activities may not be considered as an economic activity.

b. Compensation given to the victims of a cyclone is an example of a social welfare measure taken by the government. However, it is not included in the estimation of national income as it is a transfer payment that does not lead to a corresponding flow of goods and services.

Q. No. 8) a. Giving valid reasons, explain how the following would be treated while estimating domestic income.

i. Payment made by American tourists for goods purchased in India.

ii. Tomatoes grown by Ms. Puja in her kitchen garden.

b. “Machine purchased by a firm is always a capital good.” Do you agree with the given statement? Give valid reasons for your answer.

Ans. a. i. Yes, it will be included in domestic income as goods purchased by American tourists is the expenditure made by them in India and will be included as exports.

ii. No, it will not be included in domestic income because it is difficult to ascertain their market value. Moreover, such transactions are not undertaken for any monetary consideration.

b. No. Capital goods are those final goods that help in the production of other goods and services. A machine purchased by a firm will be a capital good when it is used for the production of other goods and services. However, if it is purchased by a firm for resale purposes in the same year, it will be considered as an intermediate good and not a capital good.

Q. No. 9) Giving valid reasons explain which of the following will not be included in the estimation of the National Income of India?

a. Purchase of shares of X Ltd. by an investor in the National Stock Exchange.

b. Salaries paid by the French Embassy, New Delhi to the local workers of the housekeeping department.

c. Compensation paid by the Government of India to the victims of floods.

Ans. The following will not be included in the estimation of the National Income of India:

a. As such transactions are mere paper claims and do not lead to any value addition.

c. Compensation paid by the Government of India is a mere transfer payment and does not lead to any flow of goods and services in an economy.

Q. No. 10) Will the following factor income be included in the domestic factor income of India? Give reasons for your answer:

i. Compensation of employees to the resident of Japan working in the Indian embassy in Japan.

ii. Payment of fees to a Chartered Accountant by a firm.

iii. Rent received by an Indian resident from the Russian embassy in India.

iv. Compensation given by an insurance company to an injured worker.

Ans. i. Yes, it will be included as it is part of the Factor Income earned in the domestic territory of the country.

ii. Payment of fees to a Chartered Accountant is an intermediate expenditure for the firm. Hence, it is to be deducted from the value of the output of the firm to obtain value added. Hence it is not included in the domestic factor income of India.

iii. No, as rent received by Indian residents from the Russian embassy will be part of the Factor Income received from abroad as the Russian Embassy is not part of the domestic territory of the country.

iv. No, as compensation is given by the insurance company to the employee and not by the employer.

Q. No. 11) State under what conditions in the following statements may be true:

a. GNDI is equal to GNP at market prices.

b. Domestic Income is greater than National Income

c. Value of output is equal to Value added

Ans. a. When net current transfers from abroad are zero.

b. When Net factor income from abroad is negative.

c. When intermediate consumption is zero.

Q. No. 12) State the various components of the Expenditure Method that are used to calculate national income.

Ans. Components of Expenditure method:

- Private Final Consumption Expenditure

- Government Final Consumption Expenditure

- Investment Expenditure

- Net Exports.

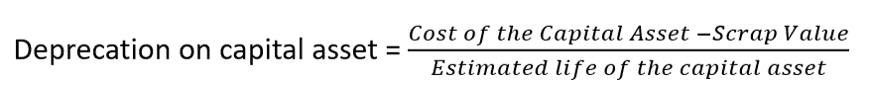

Q. No. 13) Calculate ‘Depreciation on Capital Asset’ from the following data:

| Particulars | Amount (in ₹ Crores) |

| i. Capital Value of the asset | 1,000 |

| ii. Estimated life of the asset | 20 years |

| iii. Scrap Value | Nil |

Ans. We know,

⇒ Depreciation = 1000-0/20 = 1000/20 = ₹ 50 crores per year.

Q. No. 14) Distinguish between ‘Value of Output’ and ‘Value Added’.

Ans. Value of output is the estimated money value of all the goods and services, inclusive of change in stock and production for self-consumption. Whereas, Value added is the excess of value of output over the value of intermediate consumption.

Q. No. 15) In an economy, the following transactions took place. Calculate the value of output and value added by Firm B:

- Firm A sold to Firm B goods of Rs. 80 crores; to Firm C Rs. 50 crores; to household Rs. 30 crores and goods of value Rs. 10 crores remain unsold.

- Firm B sold to Firm C goods of Rs. 70 crores; to Firm D Rs. 40 crores; goods of value Rs. 30 crores were exported and goods of value Rs. 5 crores were sold to the government.

Ans. Value of output of firm B = Sales of firm B to firm C + Sales of firm B to firm D + Exports + Sales of firm B to Government

= 70 + 40 + 30 + 5 = Rs. 145 crores.

Value added by Firm B = Value of output by Firm B – Purchases by Firm B from Firm A

= 145 – 80 = Rs. 65 crores.

Q. No. 16) Suppose in a hypothetical economy there are only two Firms A and B. Firm A sold goods for ₹ 2,000 to Firm B and purchased goods for ₹ 1,000. Firm B exported goods for ₹ 2,500 and had domestic sales of ₹ 1,500. Calculate Net Domestic Product at market price, if consumption of fixed capital is ₹ 200.

Ans.

| Value of Output (in ₹) | Intermediate Consumption (in ₹) | Value Addition (in ₹) | |

| A | 2000 (to B) | 1000 (Purchases) | 2000 - 1000 = 1000 |

| B | 2500 (exports) + 1500 (domestic sales) = 4000 | 2000 (purchased from A) | 4000-2000 = 2000 |

| Total | 6000 | 3000 | 3000 |

Net Domestic Product at MP = Gross Domestic Product at MP – Consumption of Fixed Capital

= 3,000 – 200 = ₹ 2,800

Q. No. 17) Given the following data, find Net Value Added at Factor Cost by Sambhav (a farmer) producing Wheat:

| Items | (₹ in crore) |

| i. Sale of wheat by the farmer in the local market | 6800 |

| ii. Purchase of Tractor | 5000 |

| iii. Procurement of Wheat by the Government from the farmer | 200 |

| iv. Consumption of Wheat by the farming family during the year | 50 |

| v. Expenditure on the maintenance of existing capital stock | 100 |

| vi. Subsidy | 20 |

Ans. Net Value Added at Factor cost (NVAFC) = (i) + (iii) + (iv) + (vi) – (v)

= 6800 + 200 + 50 + 20 – 100 = ₹ 6,970 crore.

Q. No. 18) State any two components of ‘Net Factor Income from Abroad’.

Ans. Components of net factor income from abroad are:

- Net Compensation of employees

- Net income from property and entrepreneurship

- Net retained earnings of resident companies abroad.

Q. No. 19) Compute (a) National Income and (b) Personal Disposable Income.

| Items | Amount (in ₹ crores) |

| i. Mixed income of self-employed | 2500 |

| ii. Net factor income from abroad | (-) 50 |

| iii. Rent | 500 |

| iv. Private Income | 4000 |

| v. Consumption of Fixed Capital | 400 |

| vi. Corporation Tax | 700 |

| vii. Profits | 300 |

| viii. Net Retained Earnings of Private Enterprises | 500 |

| ix. Compensation of Employees | 1600 |

| x. Net Indirect Taxes | 500 |

| xi. Net Current Transfers from Abroad | 150 |

| xii. Net Exports | (-) 40 |

| xiii. Interest | 500 |

| xiv. Direct Taxes paid by households | 300 |

Ans.

(a) NDPfc = Compensation of employees + Rent + Interest + Profit + Mixed Income

= ix + iii + xiii + vii + i = 1600 + 500 + 500 + 300 + 2500 = 5400

National Income (NNPfc) = NDPfc + NFIA = NDPfc + (ii) = 5400 + (-50) = 5350 crores

Or,

National Income = (ix) + [ (iii) + (xiii) + (vii)] + (i) + (ii) = 1600 + (500 + 500 + 300) + 2500 + (-50)

= ₹ 5350 crores

(b) Personal Disposable Income = (iv) – (vi) – (viii) – (xiv) = 4000 – 700 – 500 – 300 = ₹ 2500 crores.

Q. No. 20) Suppose in an imaginary economy GDP at market price in a particular fiscal year was ₹ 4,000 crores, National Income was ₹ 2,500, Net Factor Income paid by the economy to the Rest of the World was ₹ 400 crores, and the value of Net Indirect Taxes is ₹ 450 crores. Estimate the value of consumption of fixed capital for the economy from the given data.

Ans. NNPfc = GDPmp – Consumption of fixed capital – Net factor income to abroad – Net indirect taxes

⇒ 2500 = 4000 – CFC – 450 – 400

⇒ 2500 = 3150 – CFC

⇒ CFC = ₹ 650 crores

Q. No. 21) Find National Income from the following using the expenditure method:

| Items | Amount (in ₹ crores) |

| i. Current transfers from rest of the world | 50 |

| ii. Net Indirect taxes | 100 |

| iii. Net Exports | -25 |

| iv. Rent | 90 |

| v. Private Final Consumption Expenditure | 900 |

| vi. Net Domestic Capital Formation | 200 |

| vii. Compensation of Employees | 500 |

| viii. Net Factor Income from Abroad | -10 |

| ix. Government Final Consumption Expenditure | 400 |

| x. Profit | 220 |

| xi. Mixed Income of Self Employed | 400 |

| xii. Interest | 230 |

Ans. National Income by Expenditure Method

GDPmp = Private Final Consumption Expenditure + Government Final Consumption Expenditure + Gross Domestic Capital Formation + Net Exports

= v + ix + vi + iii = 900 + 400 + 200 + (-25) = 1475

National Income (NNPfc) = GDPmp - Depreciation + NFIA - NIT = 1475 - 0 + (-10) - 100 = ₹ 1365 crores

Or,

National Income = Private Final Consumption Expenditure + Government Final Consumption Expenditure + Net Domestic Capital Formation + Net Exports + NFIA – NIT

= v + ix + vi + iii + viii – ii

= 900 + 400 + 200 + (-25) + (-10) – 100

= ₹ 1365 crores

Q. No. 22) On the basis of the given data, estimate the value of Domestic Income:

| Items | Amount (in ₹ crores) |

| i. Household Consumption Expenditure | 600 |

| ii. Gross Fixed Capital Formation | 200 |

| iii. Change in Stock | 40 |

| iv. Government Final Consumption Expenditure | 200 |

| v. Net Exports | (-) 40 |

| vi. Net Indirect taxes | 120 |

| vii. Net Factor Income from Abroad | 20 |

| viii. Consumption of Fixed Capital | 40 |

Ans. Gross domestic capital formation (GDCF) = Net domestic fixed capital formation + (Closing stock - Opening stock) + Consumption of fixed capital = 200 + 40 = 240

By Expenditure Method:

GDPmp = Private final consumption expenditure (PFCE) + Government final consumption expenditure (GFCE) + Gross domestic capital formation (GDCF) (Gross Investment) + Net exports

= i + iv + GDCF + v

= 600 + 200 + 240 + (-) 40

= ₹ 1000 crores

Domestic Income (NDPFC)

= 1000 - (viii) - (vi)

= 1000 - 40 - 120

=₹ 840 crore

Q. No. 23) Compute (a) Domestic Income and (b) Net National Disposable Income.

| Items | Amount (in ₹ crores) |

| i. Net Exports | 155 |

| ii. Government Final Consumption Expenditure | 2500 |

| iii. Subsidies | 120 |

| iv. Gross Domestic Fixed Capital Formation | 1190 |

| v. Net Factor Income to Abroad | 125 |

| vi. Net decrease in inventories | 100 |

| vii. Net Exports | (-) 420 |

| viii. Net Indirect Taxes | 470 |

| ix. Net Current transfers from abroad | 350 |

| x. Current replacement cost | 145 |

| xi. Private Final Consumption Expenditure | 2200 |

Ans. (a) By Expenditure Method,

GDCF= Net domestic fixed capital formation + (Closing stock - Opening stock) + Consumption of fixed capital

= (1190-145) + (-100) + 145

= 1090

∴ GDPmp = Private final consumption expenditure (PFCE) + Government final consumption expenditure (GFCE) + Gross domestic capital formation (GDCF) + Net exports

= xi + ii + GDCF + vii

= 2200 + 2500 + 1090 + (-420)

= 5370

∴ Domestic Income (NDPfc)

= GDPmp - Depreciation - NIT

= GDPmp - (x) - (viii)

= 5370 - 145 - 470

= ₹ 4755 crores

(b) Net National Disposable Income = Net National Product at market prices (NNPmp) + Other Net current transfers from the rest of the world

= NDPfc + NFIA + NIT + Other Net current transfers from the rest of the world

= 4755 + (-125) + 470 + 350

= ₹ 5450 crores

Q. No. 24) Calculate the compensation of employees from the following data:

| Items | Amount (in ₹ crores) |

| i. Profits after tax | 20 |

| ii. Interest | 45 |

| iii. Gross Domestic Product at market price | 200 |

| iv. Goods and Services Tax | 10 |

| v. Consumption of Fixed Capital | 50 |

| vi. Rent | 25 |

| vii. Corporate Tax | 5 |

Ans. We know,

NDPfc = Compensation of employees (CoE) + Rent + Interest + Profit + Mixed income (if any)

⇒ GDPmp - Depreciation - NIT = CoE + Rent + Interest + Profit

⇒ 200 - 50 - 10 = CoE + 25 + 45 + (20 +5)

⇒ 140 = CoE + 95

⇒ CoE = ₹ 45 crores

Q. No. 25) From the following data calculate the value of Domestic Income:

| Items | Amount (in ₹ crores) |

| i. Compensation of Employees | 2000 |

| ii. Rent and Interest | 800 |

| iii. Indirect Taxes | 120 |

| iv. Corporate Tax | 460 |

| v. Consumption of Fixed Capital | 100 |

| vi. Subsidies | 20 |

| vii. Dividend | 940 |

| viii. Undistributed Profits | 300 |

| ix. Net Factor Income from Abroad | 150 |

| x. Mixed Income of Self Employed | 200 |

Ans. By Income Method:

NDPfc (Domestic Income) = Compensation of employees + Rent and royalty + Interest + Profit + Mixed income (if any)

= i + ii + (vii + viii) + x

= 2000 + 800 + 940 + 300 + 200

= ₹ 4240 crores

Q. No. 26) What is meant by the problem of double counting? How this problem can be avoided?

Ans. The problem of double counting arises when the value of certain goods and services is counted more than once while estimating National Income by Value Added Method. This happens when the value of intermediate goods is counted in the estimation of National Income along with the final value of goods and services.

Two methods to avoid the problem of double counting:

- To consider only the final value of output produced.

- To consider only the value added to the output produced.

Q. No. 27) a) State the various precautions of the Product Method/value-added method that should be kept in mind while estimating national income.

b) State and discuss any two precautions to be considered while estimating national income by Expenditure Method.

Ans. a. Precautions of Product Method/value-added method:

- Avoid double counting

- Production for self-consumption should be included.

- The sale of second-hand goods is not to be included.

- Production from illegal activities is not to be included.

- The value of services rendered by housewives/family members is not to be included.

b. Precautions of Expenditure Method:

- Expenditure on second-hand goods is not to be included in the final consumption expenditure as the production of these goods might not be attributed to the current year.

- Expenditure on ‘intermediate goods’ are not to be taken into account, to avoid the problem of double counting of value of goods and services.

Q. No. 28) Suppose the Gross Domestic Product (GDP) of Nation X was ₹ 2,000 crores in 2018-19, whereas the Gross Domestic Product of Nation Y in the same year was ₹ 120,000 crores. If the Gross Domestic Product of Nation X rises to ₹ 4,000 crores in 2019-20 and the Gross Domestic Product of Nation Y rises to ₹ 200,000 crores in 2019-20.

Compare the rate of change of GDP of Nations X and Y, taking 2018-19 as the base year.

Ans.

| 2018-19 | 2019-20 | GDP Growth Rate = Change in GDP/Base year GDP x 100 (Base year = 2018-19) | |

| X | ₹ 2,000 crores | ₹ 4,000 crores | 4,000-2,000/2,000 x 100 = 2000/2000 x 100 = 100% |

| Y | ₹ 120,000 crores | ₹ 200,000 crores | 200000-120000/120000 x 100 = 80000/120000 x 100 = 66.67 % |

Nation X has registered a GDP growth rate of 100% and has performed better on the front of GDP rise as compared to Nation Y which has registered a GDP growth rate of 66.67%.

Q. No. 29) “India’s GDP is expected to expand 7.5% in 2019-20: World Bank”

-The Economic Times.

Does the given statement mean that the welfare of the people of India increases at the same rate? Comment with reason.

Ans. Generally, it is considered that an increase in the Gross Domestic Product (GDP) of any economy (India in this case) ensures an increase in the welfare of the people of the country. However, this may not always be correct. Some of the prime reasons for the same are:

- Unequal distribution and composition of GDP,

- Non-monetary transactions in the economy which are not accounted for in GDP, and

- Occurrence of externalities in the economy (both positive and negative).

Q. No. 30) State the meanings of the following:

i. Externalities

ii. Operating Surplus

iii. Consumption Goods

Ans. i. Externalities: Externalities refer to benefits (positive externalities)/harms (negative externalities) which are caused by one entity to another without being paid/penalized for it.

ii. Operating Surplus: Operating Surplus is the sum total of rent, royalties, interest, and profits. It is also known as non-wage income.

iii. Consumption Goods: Goods that are consumed by the ultimate consumers or meet the immediate need of the consumer are called consumption goods. It may include services as well.

Q. No. 31) Discuss any two differences between GDP at constant prices and GDP at current Prices.

Or,

Differentiate between real GDP and nominal GDP.

Or,

Differentiate between National Income at current prices and National Income at constant prices. Which of the two presents a better view of the economic growth of the economy and why?

Ans.

| Real GDP/GDP at constant prices | Nominal GDP/GDP at current prices |

| i. GDP at constant prices are measured at base year's prices. | i. GDP at constant prices is measured at current year's prices. |

| ii. It will increase only when there is increase in the flow of goods and services. | ii. It may increase even if there is no increase in the flow of goods and services. |

| iii. It presents a better view of economic growth of the economy. | iii. It does not present a better view of economic growth of the economy. |

Q. No. 32) ‘Real Gross Domestic Product is a better indicator of economic growth than Nominal Gross Domestic Product’.

Do you agree with the given statement? Support your answer with a suitable numerical example.

Ans. The given statement is correct. Real GDP is a better indicator of economic growth than Nominal GDP as it is not affected by changes in the general price level.

Numerical example:

| Goods | Current Year Price (in ₹) | Base Year Price (in ₹) | Quantity of current year (in units) | Nominal GDP | Real GDP |

| A | 20 | 10 | 100 | 20x100=2000 | 10x100=1000 |

| B | 10 | 5 | 200 | 10x200=2000 | 5x200=1000 |

| C | 30 | 20 | 50 | 30x50=1500 | 20x50=1000 |

| Total = ₹ 5500 | Total = ₹ 3000 |

In the above example, the difference between Real GDP and Nominal GDP is ₹ 5500 – ₹ 3000 = ₹ 2500.

This is only the monetary difference as the quantity sold in the market remains unchanged and the variation in the value of GDP is merely due to the change in the prices in the economy.

Q. No. 33) Explain any four limitations of using GDP as a measure/index of the welfare of a country.

Ans. Four limitations of using GDP as a measure/index of the welfare of a country are:

- Distribution of GDP

- Composition of GDP

- Non-Monetary Exchanges

- Externalities.

Q. No. 34) Define GDP deflator and discuss its importance.

Ans. The GDP deflator is the ratio of Nominal GDP to Real GDP. It is a tool that is used to eliminate the effect of price fluctuations in the economy and to determine the real change in the physical output of the current year. GDP deflator helps in comparison of the growth rate of the economy.

Q. No. 35) Estimate the value of Nominal GDP for a hypothetical economy, the value of Real GDP and Price Index are given as ₹ 500 crores and 125 respectively.

Ans. We know,

Price index = Nominal GDP/Real GDP x 100

⇒ Nominal GDP = Real GDP x Price Index/100 = 500 x 125/100 = ₹ 625 crores.

Q. No. 36) Use the following information about an imaginary country:

| Year | 2014-15 | 2015-16 | 2016-17 |

| Nominal GDP | 6.5 | 8.4 | 9 |

| GDP Deflator | 100 | 140 | 125 |

i. For which year is real GDP and nominal GDP the same and why?

ii. Calculate real GDP for the given years. Is there any year in which real GDP falls?

Ans. i. For the year 2011 as it is the base year.

ii.

| Year | 2014-15 | 2015-16 | 2016-17 |

| Nominal GDP | 6.5 | 8.4 | 9 |

| GDP Deflator | 100 | 140 | 125 |

| Real GDP = Nominal GDP/GDP Deflator x 100 | 6.5 | 6 | 7.2 |

The real GDP declined in the year 2015-16. It could be due to a high rate of inflation or price levels.

Q. No. 37) Explain how ‘Non-Monetary Exchanges’ impact the use of GDP as an index of economic welfare.

Ans. Non-monetary exchange transactions are not included in the estimation of GDP on account of practical difficulties like the non-availability of reliable data. Although these activities enhance public welfare which may lead to under-estimation of GDP.

For example kitchen gardening, services of homemaker, etc.

Q. No. 38) ‘GDP as an index of welfare may understate or overstate welfare.’

Explain the statement using examples of a positive and a negative externality.

Ans. GDP does not account for externalities.

- Positive externality: Example – saving commuting time due to the construction of a fly-over, increases welfare, GDP as an index understates welfare.

- Negative externality: Example – pollution from factories, decreases welfare, GDP overstates welfare.

Q. No. 39) Distinguish between positive externalities and negative externalities.

Ans.

| Positive Externalities | Negative Externalities |

| i. Negative externalities refer to the harm caused by one entity to another without being penalized for it. | i. Negative externalities refer to the harm caused by one entity to another without being penalized for it. |

| ii. Example – saving commuting time due to the construction of a fly-over. | ii. Example – pollution from factories. |

| Also See: Indian Economy on the Eve of Independence Class 12 Important Questions and Answers National Income and Related Aggregates Class 12 Notes |

| Also Read: Class 12 Important Questions Class 12 Notes |

Hope you liked these notes on Class 12 Economics National Income and Related Aggregates. Please share this with your friends and do comment if you have any doubts/suggestions to share.

Sir results are out I got ❣️85.6% all because of you thankyou so much 💯💯💯😊😊😊😊😊😊😊😊

Wow 🤩. Congratulations 👏

Please check the 21 question

In question no. 25 why corporate tax is not added? It is part of profit .

yyes it should be added and answer should be 4400.