Are you studying for your Class 12 CBSE Board Exam and need help with Macroeconomics Chapter 4 Determination of Income and Employment? Look no further! We have compiled a list of important questions and answers to help you prepare for your exam. With these resources, you'll be well-equipped to ace your exam and achieve success in your studies.

| Board | CBSE and State Boards |

| Class | 12 |

| Subject | Economics |

| Book Name | Macroeconomics |

| Chapter No. | 4 |

| Chapter Name | Determination of Income and Employment |

| Type | Important Questions Answers |

| Session | 2024-25 |

| Weightage | 12 marks |

"Don't wait for the right time. Create it."

Determination of Income and Employment Class 12 Economics Important Questions Answers

Q. No. 1) Multiple Choice Questions (MCQs)

i. Given below are some basic activities that occur in an economy. Identify the activity that would not help to study the economy in its totality.

a. government introducing policies

b. aggregate demand and supply of goods

c. determination of the consumer’s equilibrium

d. determination of equilibrium level of income and employment

Ans. Option (c)

ii. Average Propensity to Consume can never be ………………………... (choose the correct alternative)

a. positive

b. zero

c. more than one

d. less than one

Ans. Option (b)

iii. Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

- Assertion (A): Ex-post Investments represent planned Investments; whereas ex-ante Investments represent the actual level of investments.

- Reason (R): At the equilibrium level, Ex-ante Savings and Ex-ante Investments are always equal.

Alternatives:

a. Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b. Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c. Assertion (A) is true but Reason (R) is false.

d. Assertion (A) is false but Reason (R) is true.

Ans. Option (d)

iv. Read the following statements carefully:

- Statement 1: The consumption function assumes that consumption changes at a constant rate as income changes.

- Statement 2: Autonomous consumption is the ratio of total consumption (C) to total income (Y).

In light of the given statements, choose the correct alternative from the following:

a. Statement 1 is true and Statement 2 is false.

b. Statement 1 is false and Statement 2 is true.

c. Both Statements 1 and 2 are true.

d. Both Statements 1 and 2 are false.

Ans. Option (a)

v. Read the following statements carefully:

- Statement 1: Aggregate demand is the sum total of consumption and investment expenditures.

- Statement 2: Total consumption consists of an autonomous component and an induced component.

Choose the correct option based on the above statements.

a. Statement 1 is true and statement 2 is false

b. Statement 1 is false and statement 2 is true

c. Both statements 1 and 2 are true

d. Both statements 1 and 2 are false

Ans. Option (c)

vi. The value of __________ can be greater than one.

(Choose the correct alternative to fill up the blank)

a. Marginal Propensity to Consume

b. Average Propensity to Consume

c. Marginal Propensity to Save

d. Average Propensity to Save

Ans. Option (b)

vii. Read the following statements carefully:

- Statement 1: The consumption curve is an upward-sloping straight-line curve due to the direct relationship between income and consumption and the assumption of constant Marginal Propensity to Consume.

- Statement 2: Aggregate Demand curve and Consumption curve are parallel to each other.

In the light of the given statements, choose the correct alternative from the following:

a. Statement 1 is true and statement 2 is false

b. Statement 1 is false and statement 2 is true

c. Both statements 1 and 2 are true

d. Both statements 1 and 2 are false

Ans. Option (c)

viii. The total consumption and investment curves are given below:

Identify which of the following represents “Autonomous Consumption”.

a. OR

b. RC

c. RY

d. RI

Ans. Option (a)

ix. Suppose for a given economy,

S= -60 + 0.1Y

I= ₹ 4,000 crore

(Where S = Saving Function, Y = National Income and I = Investment Expenditure)

The equilibrium level of Income would be ₹ ______ crore.

(Choose the correct alternative to fill up the blank)

Alternatives:

a. 4,000

b. 40,000

c. 40,600

d. 60,400

Ans. Option (c) [At equilibrium, S = I ⇒ -60 + 0.1Y = 4000 ⇒ Y = 40600]

x. As the Marginal Propensity to Save (MPS) increases, the value of the investment multiplier ____________. (Choose the correct alternative)

a. increases

b. decreases

c. becomes zero

d. does not change

Ans. Option (b)

xi. Graphically, the Aggregate Demand function can be obtained by vertically adding the _________ and _________ functions.

(Choose the correct alternative to fill up the blanks)

a. consumption, saving

b. consumption, investment

c. investment, saving

d. aggregate supply, consumption

Ans. Option (b)

xii. What is the value of the investment multiplier, when the Marginal Propensity to Consume (MPC) is 0.1?

a. 10

b. 1.1

c. 0.01

d. 100

Ans. Option (b) [K = 1/1-MPC = 1/1-0.1 = 1/0.9 = 10/9 = 1.1]

xiii. Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

- Assertion (A): The saving curve makes a negative intercept on the vertical axis at a zero level of income.

- Reason (R): The saving function refers to the functional relationship between saving and income.

Alternatives:

a. Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

b. Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

c. Assertion (A) is true but Reason (R) is false.

d. Assertion (A) is false but Reason (R) is true.

Ans. Option (b)

xiv. If in an economy, the value of the investment multiplier is 4 and Autonomous Consumption is ₹ 30 Crore, the relevant consumption function would be:

a. C=30+0.75 Y

b. C=(-)30+0.25Y

c. C=30-0.75Y

d. C=30-0.25Y

Ans. Option (a)

[K = 4 ⇒ 1/1-MPC = 4 ⇒ MPC = 3/4 = 0.75

∴ C = C̅ + bY = 30 + 0.75Y]

xv. There are two statements given below, marked as Statement (1) and Statement (2). Read the statements and choose the correct option.

- Statement (1) When aggregate supply is plotted as a 45°line graph, the economy is said to be at equilibrium.

- Statement (2) The total amount spent on aggregate demand is equal to the total expenditure in the country.

a. Statement 1 is true and statement 2 is false

b. Statement 1 is false and statement 2 is true

c. Both statements 1 and 2 are true

d. Both statements 1 and 2 are false

Ans. Option (c)

xvi. Choose the equation that represents the equilibrium condition in a two-sector economy.

a. Y = C̅/MPS

b. Y = C̅/1−MPS

c. Y = C̅+I¯/1−MPC

d. Y = C̅+I ̅/MPC

Ans. Option (c)

xvii. If the increase in National Income is equal to an increase in consumption, identity the value of Marginal Propensity to Save :

a. Equal to unity

b. Greater than one

c. Less than one

d. Equal to zero

Ans. Option (d)

[△Y = △C

∴ MPC = △C/△Y = 1

⇒ MPS = 1 - MPC = 1-1 =0]

Q. No. 2) Read the following news report and answer questions on the basis of the same:

The Reserve Bank of India (RBI), cut Repo Rate to 4.4%, the lowest in at least 15 years. Also, it reduced the Cash Reserve Ratio (CRR) maintained by the banks for the first time in over seven years. CRR for all banks was cut by 100 basis points to release ₹ 1.37 lakh crores across the banking system. RBI governor Dr. Shaktikanta Das predicted a big global recession and said India will not be immune. It all depends on how India responds to the situation. Aggregate demand may weaken and ease core inflation.

The Economic Times; March 27th, 2020

i. Cut in Repo rate by RBI is likely to……….. (increase/decrease) the demand for goods and services in the economy. (choose the correct alternative)

Ans. increase

ii. Decrease in Cash Reserve Ratio will lead to…...........… (choose the correct alternative)

a. fall in aggregate demand

b. no change in aggregate demand

c. rise in aggregate demand

d. fall in the general price level

Ans. Option (c)

iii. The difference by which actual Aggregate Demand exceeds the Aggregate Demand, required to establish full employment equilibrium is known as……….………(inflationary gap/deflationary gap). (choose the correct alternative)

Ans. Inflationary gap

iv. The impacts of "Excess Demand‟ under the Keynesian theory of income and employment, in an economy are: (choose the correct alternative)

a. decrease in income, output, employment, and general price level

b. decrease in nominal income, but no change in real output

c. increase in income, output, employment, and general price level

d. no change in output/employment but an increase in the general price level.

Ans. Option (d)

Q. No. 3) In an economy, the break-even point and equilibrium point may lie at the same level of income, if ex-ante investments are _____.

Ans. Zero.

Q. No. 4) Estimate the value of Aggregate Demand in an economy if:

a. Autonomous Investment (I) = ₹ 100 Crore

b. Marginal Propensity to Save = 0.2

c. Level of Income (Y) = ₹ 4,000 crores

d. Autonomous Consumption Expenditure (c) = ₹ 50 Crore

Ans. The Aggregate Demand (AD) function is given as:

AD = C +I

⇒ AD = (C̅ +bY}+I

Now, C̅ = 50 (Given)

b or MPC = 1 – MPS = 1 – 0.2 = 0.8

Y = 4000 (Given)

I = 100 (Given)

Substituting the values of c and b in AD function, we get :

AD = {50+ 0.8 (4000)}+100 = ₹ 3,350 crores

Aggregate Demand is ₹ 3,350 crores.

Q. No. 5) Estimate the value of ex-ante AD, when autonomous investment and consumption expenditure (A) is ₹ 50 crores, MPS is 0.2 and the level of income is ₹ 300 crores.

Ans. We know, MPC = 1 – MPS

⇒ MPC = 1 – 0.2

⇒ MPC = 0.8

∴ AD = C+I

⇒ AD = C̅ +bY + I

⇒ AD = C̅ + I + bY

⇒ AD = 50 + 0.8 (300) [∵ C̅ + I = 50]

⇒ AD = ₹ 290 Crores

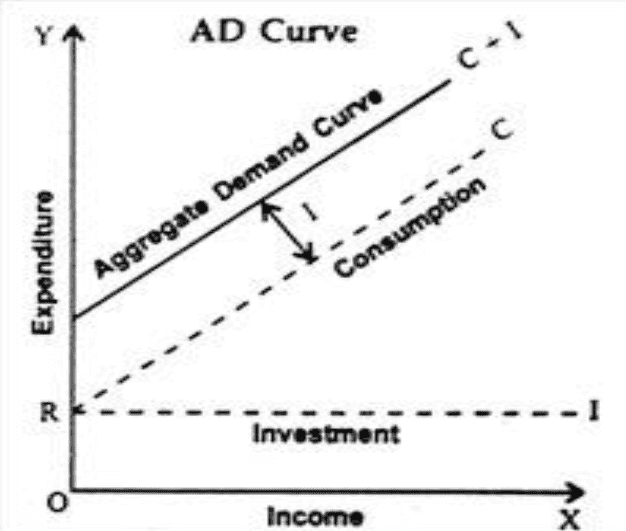

Q. No. 6) Derive a straight-line saving curve using the following consumption function:

C = 20 + 0.6Y

Presuming the income levels to be ₹ 100, ₹ 200, and ₹ 300 crores.

Also, calculate the level of income where consumption is equal to income.

Ans. S = Y - C

Given the consumption function:

C = 20 + 0.6Y

We can substitute the consumption function into the saving function:

S = Y - (20 + 0.6Y) = Y - 20 - 0.6Y = 0.4Y - 20

| When, Y = ₹100 crores, S = 0.4 x 100 - 20 S = 40 - 20 S = ₹20 crores | When, Y = ₹200 crores, S = 0.4 x 200 - 20 S = 80 - 20 S = ₹60 crores | When, Y = ₹300 crores, S = 0.4 x 300 - 20 S = 120 - 20 S = ₹100 crores |

Therefore, the saving curve based on the given consumption function is as follows:

| Income (Y) | Savings (S) |

| 100 | 20 |

| 200 | 60 |

| 300 | 100 |

Now, let's find the level of income where consumption is equal to income:

C = Y

⇒ 20 + 0.6Y = Y

⇒ 0.6Y = Y - 20

⇒ 0.6Y - Y = -20

⇒ -0.4Y = -20

⇒ Y = -20 / -0.4

⇒ Y = 50

So, the level of income where consumption is equal to income is ₹50 crores.

Q. No. 7) What is the range of values of investment multiplier? Clarify the relation of investment multiplier with the marginal propensity to consume (MPC) and with the marginal propensity to save (MPS).

Ans. Range of Investment Multiplier = one to infinity.

Relation: if MPC rises, investment multiplier: positive relation,

whereas if MPS rises, investment multiplier falls: inverse relation.

Q. No. 8) Define i) Ex-Ante Savings ii) Full Employment.

Ans. i) Ex-ante savings - Ex ante savings refers to the planned savings of an economy at different levels of income.

ii) Full employment – It refers to a situation, where all the willing and capable resources get a gainful job at the prevailing wage rate. It is a situation where there is no involuntary unemployment.

Q. No. 9) State one fiscal measure that can be used to reduce the gap between rich and poor.

Ans.

- Increasing the investment expenditure will directly benefit the poor.

- Increasing the taxes on the rich and using the same amount to benefit the poor.

Q. No. 10) If in an economy Saving function is given by S = (-) 50 + 0.2 Y and Y = ₹ 2000 crores; consumption expenditure for the economy would be ₹ 1,650 crores and the autonomous investment is ₹ 50 crores and the marginal propensity to consume is 0.8. True or False? Justify your answer with proper calculations.

Ans. Yes all the given values are correct

S= -50+0.2Y

⇒ S= -50+0.2(2000) =-50 +400 = ₹ 350 crores

At equilibrium level of income:

Y = C + S

⇒ 2,000 = C + 350

⇒ C = 2000 – 350 = 1,650 (in ₹ crores)

MPC + MPS = 1

⇒ MPC + 0.2 = 1

⇒ MPC = 1-0.2 = 0.8

Q. No. 11) Calculate Multiplier when MPC is 4/5 and 1/2. From the calculations establish the relation between the size of the Multiplier and the size of MPC.

Ans. Multiplier = 1/1-MPC

When, MPC = 4/5,

Multiplier (K) = 1/1-4/5 = 1/1/5 = 5

When, MPC = 1/2,

Multiplier (K) = 1/1-1/2 = 1/1/2 = 2

Observing the same we may conclude that there exists a positive or direct relation between MPC and Investment Multiplier.

The Investment Multiplier coefficient measures the change in final income with respect to a given change in the initial investment in the economy. It carries direct relation with the rate of growth in an economy, i.e. higher the MPC more chance of growth exists in an economy. But, it is a two-sided sword hence if investment falls in an economy the income may also fall.

Q. No. 12) If an economy plans to increase its income by ₹ 2,000 crore and the Marginal Propensity to Consume is 75%. Estimate the increase in investment required to achieve the targeted increase in income.

Ans. Given, MPC = 75% = 75/100 = 3/4,

ΔY = ₹ 2,000 Crore

∴ K = 1/1-MPC= 1/1−3/4 = 1/1/4 = 4

According to the question:

K = ΔY/ΔI

⇒ 4 = 2000/ΔI

⇒ ΔI = 2000/4 = ₹ 500 Crore

Therefore, the increase in investment (ΔI) required = ₹ 500 Crore.

Q. No. 13) In an economy, the initial income was ₹1000 crore which increased by ₹ 2500 crore.

Given MPS = 0.3, C̅ = ₹500, calculate the investment expenditure at the increased level of income.

Ans. Y = 3500; MPS = 0.3

∴ MPC = 1-MPS

⇒ MPC = 1-0.3 = 0.7

C̅ = 500

We know,

Y = C̅ + bY + I

⇒ 3500 = 500 + 0.7x3500 + I

⇒ I = 3500-500-2450

⇒ I = Rs. 550

Q. No. 14) Explain how the economy achieves an equilibrium level of income using Consumption + Investment (C+I) approach.

Ans. C+I approach

Aggregate demand, given by C+I, is the planned demand by the various sectors of the economy. Whether this planned demand is realized or not depends on the amount of goods and services (aggregate output or Y) produced in the economy. Thus it is only when planned expenditure is equal to the aggregate output does the economy achieve equilibrium.

i.e., AD=Y

If AD>Y, the inventory level with producers falls and they increase output.

This happens till AD=Y

The Opposite happens if AD<Y.

Q. No. 15) Explain how the economy achieves an equilibrium level of income using Savings Investment (S-I) approach.

Ans. As per the S-I approach equilibrium is achieved where ex-ante Savings are equal to ex-ante investments. Savings and investments indicate leakages and injections respectively, thus at equilibrium the leakages and injections are equal to each other.

Q. No. 16) If in an economy:

a) Consumption function is given by C = 100 + 0.75 Y, and

b) Autonomous investment is 150 crores.

Estimate (i) Equilibrium level of income and (ii) Consumption and Savings at the equilibrium level of income.

Ans. C= 100+0.75Y

I = 150

(i) At equilibrium level of income:

Y = C + I

⇒ Y=100+0.75Y + 150

⇒ Y - 0.75Y = 250

⇒ Y = 250/0.25 = 1,000 (in ₹ crores)

(ii) C =100+0.75Y = 100+0.75(1000) = 100 + 750 = 850 (in ₹ crores)

Y = C + S

or S= Y - C = 1000 - 850 = 150 (in ₹ crores)

Q. No. 17) Calculate the equilibrium level of income for a hypothetical economy, for which it is given that:

a) Autonomous Investments = ₹ 500 crores, and

b) Consumption function, C = 100 + 0.80Y

Ans. Given Consumption function is, C=100+0.8 Y

Autonomous investments= ₹ 500 crores

We know, at the equilibrium level

Y=C+I

⇒ Y=100+0.8 Y+500

⇒ Y-0.8Y=600

⇒ 0.2Y =600

⇒ Y= ₹ 3,000 crores

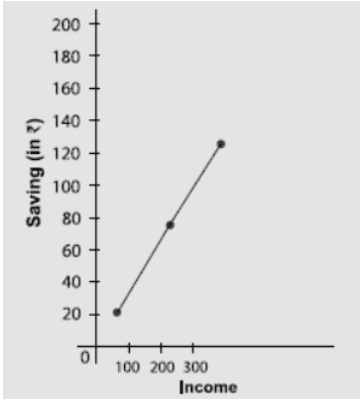

Q. No. 18) Discuss the significance of the 45-degree line in Keynesian Economics.

Ans. Aggregate Supply is obtained by adding consumption and saving schedules. The straight line obtained which will originate from the point of origin will form a 45-degree angle thereby establishing the relation of Y = C+S

| Level of Income (Y) | Consumption Expenditure (C) | Saving (Y-C) | Y = AS = C + S |

| 0 | 200 | -200 | 0 |

| 100 | 250 | -150 | 100 |

| 200 | 300 | -100 | 200 |

| 300 | 350 | -50 | 300 |

| 400 | 400 | 0 | 400 |

| 500 | 450 | 50 | 500 |

| 600 | 500 | 100 | 600 |

| 700 | 550 | 150 | 700 |

At all points on the 45-degree line, Consumption is equal to Income. It helps under the Keynesian Economic analysis. Since the two variables (consumption/Aggregate Expenditure and Income) are measured in the same units, the 45-degree line has a slope of one and it bisects the 90-degree angle formed by the two axes.

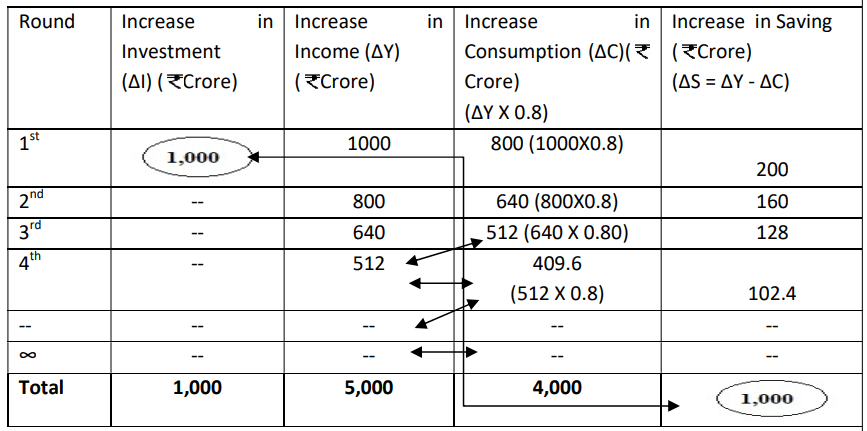

Q. No. 19) How an initial increase in investment affects the level of final income of the economy? Show its working with a suitable numerical example.

Ans. An initial increase in investment increases the final income of the economy. The investment multiplier explains this effect;

Multiplier (k) is the ratio of the increase in National Income (∆Y) due to a given increase in investments (∆I).

k = ∆Y/∆I

For eg. If an additional investment of ₹1,000 crores is made by the government for a bullet train project in a country; this extra investment will generate an extra income of ₹1,000 crores, as expenditure of one is income for another. Also, it is assumed that the Marginal Propensity to Consume in the country is 0.8.

An additional investment of ₹1,000 crores (∆I) made by the government will generate an extra income of ₹1,000 crores in the first round. If the MPC of this country is 0.8, the nationals who are receiving this additional income will spend 80% portion of this additional income, i.e. ₹800 crores which in return becomes additional income during the third round. Similarly, in the third round, ₹640 crores of income is generated.

Consumption expenditure in every round will be 0.8 times of additional income received from the previous round.

Thus, an additional investment of ₹1,000 crores leads to a total increase of ₹5,000 crores {1000x1/1-0.8} in Income. As a result, Multiplier (k) is ∆Y/∆I = 5000/1000 = 5.

Q. No. 20) Calculate the Change in Income (ΔY) for a hypothetical economy. Given that

a) Marginal Propensity to Consume (MPC) = 0.8, and

b) Change in Investment (ΔI) = ₹ 1,000 crores

Ans. Given Δ I = ₹1,000 crores

MPC = 0.8

As we know,

Multiplier (K) = 1/1-MPC = 1/1-0.8 = 1/0.2 = 10/2 = 5

We know,

K = ∆Y/∆I

⇒5 = ∆Y/1000

⇒ ΔY = ₹ 5,000 crores

Q. No. 21) Calculate the value of Marginal Propensity to Consume (MPC), if in an economy, autonomous consumption is ₹ 500 crores, ex-ante investments are ₹ 4000 crores and the equilibrium level of Income of the economy is ₹ 18,000 crores.

Ans. We know that the consumption function is: C = C̅ + bY

Given, Autonomous Consumption (C̅) = ₹ 500 crores and

Ex-ante Investments (I) = ₹ 4000 crores

At the equilibrium level of Income in the economy

Y = C + I

⇒ Y = C̅ + bY + I

⇒ 18,000 = 500 + b(18,000) + 4,000

⇒ b(18,000) = 18000 – 4500

⇒ b = 13,500/18,000

⇒ b = 0.75

Q. No. 22) For a hypothetical economy, the government incurs an investment expenditure of ₹1000 crore. If the value of Marginal Propensity to Save (MPS) falls from 0.25 to 0.10. Calculate the value of the increase in income due to a change in the value of Marginal Propensity to Save (MPS).

Ans. Given, Change in Investment (ΔI) = ₹ 1,000 crore

| MPS | Investment Multiplier (K) = 1/MPS | Change in Income (ΔY) = K x Δ I (in ₹ crores) |

| 0.25 | 1/0.25 | 4 x 1000 = 4000 |

| 0.10 | 1/0.10 | 10 x 1000 = 10000 |

Increase in Income (ΔY) = 10,000 – 4,000 = ₹ 6,000 crore

Q. No. 23) In an economy C= 200 + 0.5Y is the consumption function where C is the consumption expenditure and Y is the national income. Investment expenditure is ₹ 400 crores.

Is the economy in equilibrium at an income level ₹ 1500 crores? Justify your answer.

Ans. Given , Consumption function(C)=200+0.5Y, Investment(I)=400, Level of income (Y)=1500

At the Equilibrium level,

AD = AS

⇒ Y = C+I

⇒ Y = (200 + 0.5Y) + 400

⇒ Y – 0.5 Y = 600

⇒ Y = 600/0.5 = ₹ 1200 crores.

The equilibrium level of income = ₹ 1200 crores.

The given income (₹ 1500 crores) is greater than the equilibrium level of income (₹ 1200 crores). Therefore, the economy is not in equilibrium.

Q. No. 24) Suppose in a hypothetical economy, the savings increase by ₹ 20 crores when national income increases by ₹ 100 crores. Compute the additional investments needed to attain an increase in national income by ₹ 6,000 crores.

Ans. MPS = ∆S/∆Y = 20/100 = 1/5

Investment Multiplier (K) = 1/MPS = 1/1/5 = 5

Investment Multiplier (K) = ∆Y/∆I

⇒ 5 = 6000/∆I

⇒ ΔI = 6000/5 = ₹1200 crores

∴ An increase in investment by ₹1200 crores is required to attain an additional income of ₹6000 crores.

Q. No. 25) Assuming that there exists a situation of excess demand in an economy leading to an inflationary gap.

a) What is the impact of excess demand in the economy

b) Explain any two monetary measures that can help to control this situation.

Ans. a)

- Effect on price -Increase in the general price level, Inflationary gap,

- effect on output- no change,

- effect on employment no change.

b)

- Increase repo rate

- increase bank rate

- open market operations

- increase CRR

- increase reverse repo rate.

Q. No. 26) State whether the following statements are true or false. Give valid reasons for your answers.

(i) Unplanned inventories accumulate when planned investment is less than planned saving.

(ii) Deflationary gap exists when aggregate demand is greater than aggregate supply at full employment level.

(iii) Average propensity to save can never be negative.

Ans. i) True, as planned savings are more causing the Marginal Propensity to Consume to reduce thus Aggregate Demand will fall and producers will have an accumulation of inventory.

ii) False, Inflationary Gap exists when actual Aggregate Demand is more than Aggregate Supply corresponding to the full employment level of output in the economy.

iii) False, at income levels that are lower than the break-even point, the Average propensity to save can be negative as there will be dissaving in the economy.

Q. No. 27) ‘An economy is operating at the under-employment level of income’. What is meant by the given statement? Discuss one fiscal measure and one monetary measure to tackle the situation.

Ans. An economy is said to be operating at under employment equilibrium level, if the planned aggregate expenditure falls short of available output in the economy, corresponding to the full employment level. It results in excess of output available over the anticipated aggregate demand at full employment level.

To tackle such a situation the aggregate demand has to be increased up to the level that the stocks can be cleared.

The following measures may be taken for the same:

- Decrease in taxes: The government under its fiscal policy may decrease the rate of taxes (both direct and indirect taxes). This will ensure greater purchasing power in the hands of the general public. This will help to increase aggregate demand and remove the deflationary gap.

- Increase in money supply: Central bank through its expansionary monetary policy can increase the money supply in the economy. Central banks can use tools like bank rates, cash reserve ratios, repo and reverse repo rates etc. to ensure greater money in the hands of the general public which would in turn increase the aggregate demand in the economy and be helpful in reducing/removing the deflationary gap.

Q. No. 28) "In an economy, ex-ante Aggregate Demand is more than ex-ante Aggregate Supply." Elaborate on the possible impact of the same, on the level of output, income, and employment.

Ans. When ex-ante Aggregate Demand is more than ex-ante Aggregate Supply, it means that households are planning to consume more than what the firms expect them to. This will lead to an unintended fall in inventories.

To restore the desired /intended level of inventories, producers may expand production. As a result, there may be an increase in the level of output, employment, and income in the economy.

Q. No. 29) i. ‘As the income increases, people tend to save more’. Justify the given statement.

Ans. At a lower level of income, a consumer spends a larger proportion of his/her income on consumption expenditure (basic survival requirements). As income increases, owing to the psychological behavior of a consumer (rational), people tend to consume less and save more for future uncertainty.

ii. “Economists are generally concerned about the rising Marginal Propensity to Save (MPS) in an economy”. Explain why?

Ans. Since the sum of MPC and MPS is unity any increase in Marginal Propensity to Save (MPS) would directly lead to a decrease in Marginal Propensity to Consume (MPC). This means that may lead to a lesser proportion of the additional income going to consumption which is a vital factor of Aggregate Demand/Expenditure. This may further lead to a fall in the equilibrium level of income in the economy.

Q. No. 30) ‘Monetary measures offer a valid solution to the problem of Inflationary gap in an economy’. State and discuss any two monetary measures to justify the given statement.

Ans. Two measures which may be used to solve the problem of inflation are:

a) An increase in Cash Reserve Ratio (CRR) may reduce the credit creation capacity of the commercial banks in the economy. This may lead to a fall in the borrowings from banks causing a fall in Aggregate Demand in the economy, and helps to correct the inflationary gap in the economy.

b) Sale of Government Securities in the open market by the Central Bank will adversely affect the ability of the Commercial Banks to create credit in the economy. As a result, Aggregate Demand in the economy may fall and correct the inflationary gap in the economy.

Q. No. 31) “India’s GDP contracted 23.9% in the April-June quarter of 2020-21 as compared to the same period of 2019-20, suggesting that the lockdown has hit the economy hard”.

The Hindustan Times, 1st September 2020

State and discuss any two fiscal measures that may be taken by the Government of India to correct the situation indicated in the above news report.

Ans. The situation suggests that Aggregate Demand is less than Aggregate Supply.

The following two fiscal measures may be taken to control it:

- Decrease in Taxes - To curb the situation, the government may decrease the taxes. This may increase the purchasing power in the hands of the general public. This may increase the Aggregate Demand in the economy to bring it equal to the Aggregate Supply.

- Increase in Government Expenditure - The government may also increase its expenditure. This may increase the purchasing power in the hands of the general public which in turn may increase the Aggregate Demand in the economy to bring it equal to the Aggregate Supply.

Q. No. 32) As per the following news published in The Economic Times on 26th December 2021:

‘Reserve Bank of India has sold government securities worth ₹ 8,710 crore in the secondary market, over the last four weeks, to drain out excessive liquidity’.

Identify the likely cause and the consequences behind, this type of action plan of the Reserve Bank.

Ans. The given instance where the Reserve Bank of India has sold government securities in the secondary market indicates inflation as a possible cause behind the action taken by RBI.

By selling off the government securities, RBI withdraws money from circulation and thereby reducing the lending capacity of the commercial banks. In this process, the economy will experience a contraction of credit, leading to a reduction in consumption and investment demand. Consequently, the inflationary pressure in the economy will get eased out.

Q. No. 33) Explain how the level of effective demand is attained in an economy if, Aggregate Demand is more than Aggregate Supply.

Ans. Effective demand refers to that level of output where Aggregate demand is equal to the Aggregate supply.

If Aggregate Demand exceeds Aggregate Supply, it means buyers are planning to buy more goods and services than producers are planning to produce. Thus, the inventories in hand with the producers will start falling. As a result, producers will plan to raise the production. This will increase the level of income up to the level of Aggregate Demand is equal to Aggregate Supply.

Q. No. 34) “With an objective to reduce inflation, Reserve Bank of India may promote the commercial banks to park their surplus funds with it.”

Discuss the rationale behind the step taken by the Reserve Bank of India.

Ans. The reverse repo rate is the rate at which commercial banks may park their surplus funds with the Central Bank.

In order to decrease inflation in an economy, the Reserve Bank of India (RBI) may increase the reverse repo rate. With the increase in reverse repo rate, it becomes lucrative for commercial banks to park surplus funds with the central bank. Consequently, this may lead to a reduction in their lending capacity. Thereby, a fall in Aggregate Demand curbs the level of inflation.

Q. No. 35) “Governments across nations are too much worried about the term fiscal deficit”. Do you think that fiscal deficit is necessarily inflationary in nature? Support your answer with valid reasons.

Ans. The term fiscal deficit is the difference between the government's total expenditure and its total receipts (excluding borrowing).

Such borrowings are generally financed by issuing new currency which may lead to inflation, however, if the borrowings are for infrastructural developmental purposes this may lead to capacity building and may not be inflationary.

| Also Read: Class 12 Important Questions Class 12 Notes |

Hope you liked these Important Questions and Answers on Class 12 Economics Determination of Income and Employment. Please share this with your friends and do comment if you have any doubts/suggestions to share.