Master the concepts of Class 12 Macroeconomics Chapter 2 National Income and Related Aggregates (also known as National Income Accounting) with these class 12 notes, designed to provide a clear and concise understanding of the topic. Check out these comprehensive notes and study materials to help you ace your exams.

| Board | CBSE and State Boards |

| Class | 12 |

| Subject | Economics |

| Book Name | Macroeconomics |

| Chapter No. | 2 |

| Chapter Name | National Income and Related Aggregates (National Income Accounting) |

| Type | Notes |

| Session | 2024-25 |

| Weightage | 10 marks |

Success is not the key to happiness. Happiness is the key to success. If you love what you are doing, you will be successful.

- Albert Schweitzer

Class 12 Economics: National Income Accounting Class 12 Notes

Final Goods and Intermediate Goods

Final Goods

- Goods that are used either for final consumption by consumers or for investment by producers are known as final goods. These goods do not pass through the production process and are not used for resale. For example, bread, butter, biscuits, etc. used by the consumer

- It is not in the nature of the good but in the economic nature of its use that a good becomes a final good: Whether a good is a final good or an intermediate good depends on its use. For example, milk used by a sweet maker is an intermediate good but when it is used by the consumer it becomes a final good.

Types of Final Goods-

- Consumption goods or Consumer goods: Goods like food and clothing, and services like recreation that are consumed when purchased by their ultimate consumers are called consumption goods or consumer goods.

- Consumer goods can be durable (TV, Mobiles, etc.) and non-durable (bread, milk, etc.)

- Capital goods: Goods that are of a durable character and are used in the production process. These are tools, implements, and machines.

- Capital goods are durable.

- Investment is an addition to capital stock.

Intermediate Goods

- Intermediate goods are those goods that are meant either for reprocessing or for resale. Goods used in the production process during an accounting year are known as intermediate goods. Goods that are purchased for resale are also treated as intermediate goods. For example, Rice, wheat, sugar, etc. purchased by a retailer/wholesaler.

- Intermediate goods are not included in the calculation of national income. Only final goods are included in the calculation of national income because the value of intermediate goods is included in the value of final .goods. If it is included in national income it will lead to the problem of double counting.

Stock and Flow

Stock

- A stock is a quantity that is measured at a point of time i.e. at 4 p.m., on 31st March, etc.

- It has no time dimension.

- Wealth, population, money supply, wealth, stock, inventory, etc. are stock concepts.

Flow

- A flow is a quantity that is measured over a period of time i.e. days, months, years, etc.

- It has a time dimension.

- National income, population growth, income, change in stock, value-added, change in inventory, etc. are flow concepts.

Gross Investment and Net Investment

- Part of our final output that comprises capital goods constitutes a gross investment of an economy.

- These may be machines, tools, and implements; buildings, office spaces, storehouses, or infrastructure like roads, bridges, airports, or jetties.

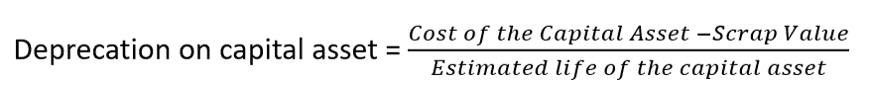

- A part of the capital goods produced this year goes for the replacement of existing capital goods and is not an addition to the stock of capital goods already existing and its value needs to be subtracted from gross investment for arriving at the measure for net investment. This part is called Depreciation.

- Depreciation is also known as 'Consumption of Fixed Capital'.

- Net Investment = Gross Investment - Depreciation

- Depreciation is thus an annual allowance for the wear and tear of a capital good.

- Depreciation is an accounting concept. No real expenditure may have actually been incurred each year yet depreciation is annually accounted for.

Circular Flow of Income

There may fundamentally be four kinds of contributions that can be made during the production of goods and services:

- the contribution made by human labor, remuneration for which is called wage

- the contribution made by capital, remuneration for which is called interest

- the contribution made by entrepreneurship, remuneration of which is profit

- the contribution made by fixed natural resources (called ‘land’), remuneration for which is called rent.

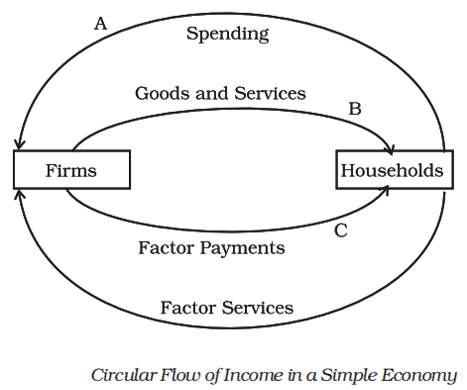

Circular flow of income in a two-sector economy

- Households are owners of factors of production, they provide factor services to the firms (producing units). Firms provide factor payments in exchange for their factor services. So, factor payments flow from firms (producing units) to households.

- Households purchase goods and services from firms (producing units) for which they make payments to them. So, consumption expenditure (spending on goods and services) flows from households to firms.

- The aggregate consumption by the households of the economy is equal to the aggregate expenditure on goods and services produced by the firms in the economy.

- The aggregate spending of the economy must be equal to the aggregate income earned by the factors of production (the flows are equal at A and C).

- Real Flow: Real flow is the flow of factor services and goods and services between households and firms.

- Nominal Flow: Nominal flow/Money flow is the flow of factor payments and payments for goods and services between households and firms.

Factor Cost and Market Price

Factor cost includes only the payment to factors of production, it does not include any tax. In order to arrive at the market prices, we have to add to the factor cost the total indirect taxes less total subsidies.

Market price - Indirect taxes (IT) + Subsidies = Factor Cost

Factor costs + Indirect taxes (I.T.) - Subsidies = Market price

⇒ Factor costs + Net Indirect tax (NIT) = Market price

- GDPmp = GDPfc + I.T. - Subsidies

- GDPmp = GDPfc + net I.T.

National Product and Domestic Product

Gross Domestic Product measures the aggregate production of final goods and services taking place within the domestic economy during a year. But the whole of it may not accrue to the citizens of the country. For example, a citizen of India working in Saudi Arabia may be earning her wage and it will be included in the Saudi Arabian GDP. But legally speaking, she is an Indian. Is there a way to take into account the earnings made by Indians abroad or by the factors of production owned by Indians? When we try to do this, in order to maintain symmetry, we must deduct the earnings of the foreigners who are working within our domestic economy, or the payments to the factors of production owned by the foreigners. For example, the profits earned by the Korean-owned Hyundai car factory will have to be subtracted from the GDP of India.

The macroeconomic variable which takes into account such additions and subtractions is known as Gross National Product (GNP).

GNP = GDP + Factor income earned by the domestic factors of production employed in the rest of the world – Factor income earned by the factors of production of the rest of the world employed in the domestic economy

Hence, GNP = GDP + Net factor income from abroad (NFIA)

- The national product includes the production activities of residents irrespective of whether performed within the economic territory or outside it.

- In comparison, the domestic product includes the production activity of the production units located in the economic territory irrespective of whether carried out by the residents or non-residents.

Gross and Net

Gross - depreciation (consumption of fixed capital) = Net

| Summary |

| 1. Gross - depreciation = Net |

| 2. Market price - N.I.T = Factor cost |

| 3. Domestic + NFIA = National |

Methods of Calculating National Income

- The Product or Value Added Method Or Production Method

- Expenditure Method Or Final Expenditure Method

- Income Method or Income Distribution Method

1. Value Added Method Or Production Method

It is now a matter of general practice to group all the production units of the economic territory into three broad groups: primary sector, secondary sector, and tertiary sectors.

Inventory: In economics, the stock of unsold finished goods, semi-finished goods, or raw materials which a firm carries from one year to the next is called inventory. It is a stock variable.

Change of inventories of a firm during a year ≡ production of the firm during the year – sale of the firm during the year. It is a flow variable.

Inventories are treated as capital. Addition to the stock of capital of a firm is known as an investment. Therefore, a change in the inventory of a firm is treated as an investment.

There can be three major categories of investment.

- First is the rise in the value of inventories of a firm over a year which is treated as investment expenditure undertaken by the firm.

- The second category of investment is fixed business investment, which is defined as the addition of the machinery, factory buildings, and equipment employed by the firms.

- The last category of investment is residential investment, which refers to the addition of housing facilities.

Changes in inventories may be planned or unplanned.

- In case of an unexpected fall in sales, the firm will have unsold stock of goods that it had not anticipated. Hence there will be an unplanned accumulation of inventories.

- In the opposite case where there is an unexpected rise in sales, there will be unplanned decumulation of inventories.

| Value added of a firm = Value of production of the firm (Value of output) – Value of intermediate goods used by the firm (value of raw materials) - - - - - -(i) |

Also, Change of inventories = production of the firm – sale of the firm

⇒ Production of the firm = Change of inventories + Sale of the firm

∴ Equation (i) can also be written as

| Value added of a firm = Change of inventories + Sale of the firm - Value of intermediate goods used by the firm |

Net Value Added = Gross Value Added - Depreciation

If we sum the gross value added of all the firms of the economy in a year, we get a measure of the value of the aggregate amount of goods and services produced by the economy in a year. Such an estimate is called Gross Domestic Product (GDP).

In the production method, we first find out Gross Value Added at Market Price (GVAmp ) in each sector and then take their sum to arrive at GDPmp.

Thus, GDPmp = Sum total of gross value added (GVAmp) of all the firms in the economy.

2. Income Method

In this method, we first estimate factor payments by each sector. The sum of such factor payments equals Net Value Added at Factor Cost (NVAfc) by that sector. Then we take sum total of NVAfc by all the sectors to arrive at NDPfc.

The components of NDPfc are:

- Compensation of employees

- Rent and royalty

- Interest

- Profits

i.e., (1) + (2) + (3) + (4) = NDPfc

Compensation of employees: It is the total remuneration in cash or in kind, payable by an enterprise to an employee in return for work done by the latter during the accounting period.

The main components of compensation of employees are :

- Wages and salaries

- in cash

- in kind

- Social security contributions by employers.

Rent: It is the amount receivable by a landlord from a tenant for the use of land.

Royalty: It is the amount receivable by the landlord for granting the leasing rights of sub-soil assets.

Interest: It is the amount payable by a production unit to the owners of financial assets in the production unit. The production unit uses these assets for production and in turn makes interest payments, imputed or actual.

Profit: It is a residual factor payment by the production unit to the owners of the production unit.

The main source of data on factor payments is the accounts of production units. Since accounts of most production units are not available to the estimators, and also since the accounting practices differ, it is not possible for the estimators to clearly identify the components. Therefore, in cases where total factors payment is estimable but not its different components, an additional factor payment item called ‘mixed income’ is added. Since this problem arises mainly in the case of self-employed people like doctors, chartered accountants, consultants, etc, this factor payment is popularly called “mixed income of the self-employed”.

In case there is such an item then,

NDPfc = Compensation of employees + Rent and royalty + Interest + Profit + Mixed income (if any)

There is another term used in factor payments. It is ‘operating surplus’. It is defined as the sum of rent and royalty, interest, and profits.

Operating Surplus = Rent and royalty + Interest + Profit

∴ NDPfc = Compensation of employees + operating surplus + mixed income (if any)

Once we estimate NDPfc, we can find NNPfc, or national income, by adding NFIA.

NDPfc + NFIA = NNPfc.

3. Final Expenditure Method

In this method, we take the sum of final expenditures on consumption and investment. This sum equals GDPmp. These final expenditures are on the output produced within the economic territory of the country.

Its main components are: Private final consumption expenditure (PFCE) + Government final consumption expenditure (GFCE) + Gross domestic capital formation (GDCF) (Gross Investment) + Net exports (= export - imports) (X-M) = GDPmp

=GDPmp - Depreciation + NFIA -NIT

= NNPfc

= National Income

Note:

- GDCF= Net domestic fixed capital formation + (Closing stock - Opening stock) + Consumption of fixed capital

- Closing stock - opening stock = Net change in stocks.

Precautions in making estimates of National Income:

A. Value Added (Production) Method:

- Avoid Double Counting: Value added equals value of output less intermediate cost. There is a possibility that instead of counting ‘value added’ one may count the value of output. You can verify by taking some imaginary numerical example that counting only values of output will lead to counting the same output more than once. This will lead to an overestimation of national income. There are two alternative ways of avoiding double counting: (a) count only value-added and (b) count only the value of final products.

- Do not include the sale of second-hand goods: Sale of the used goods is not a production activity. The good should not be treated as fresh production and therefore doesn’t qualify for inclusion in national income. However, any brokerage or commission paid to facilitate the sale is a fresh production activity. It should be included in production but to the extent of brokerage or commission only.

- Self-consumed output must be included: Output produced but retained for self-consumption, rather than selling in the market, is output and must be included in estimates. Services of owner-occupied buildings, farmers consuming their own produce, etc. are some examples

B. Income Distribution Method:

- Avoid transfers: National income includes only factor payments, i.e. payment for the services rendered to the production units by the owners of factors. Any payment for which no service is rendered is called a transfer, and not a production activity. Gifts, donations, charities, etc. are the main examples. Since transfers are not a production activity it must not be included in national income.

- Avoid capital gain: Capital gain refers to the income from the sale of second-hand goods and financial assets. Income from the sale of old cars, old houses, bonds, debentures, etc. are some examples. These transactions are not production transactions. So, any income arising to the owners of such things is not a factor income.

- Include income from the self-consumed output: When a house owner lives in that house, he does not pay any rent. But in fact, he pays rent to himself. Since rent is a payment for services rendered, even though rendered to the owner itself, it must be counted as a factor payment.

- Include free services provided by the owners of the production units: Owners work in their own units but do not charge salaries. Owners provide finance but do not charge any interest. Owners do production in their own buildings but do not charge rent. Although they do not charge, the services have been performed. The imputed (estimated) value of these must be included in national income.

C. Final Expenditure Method:

- Avoid intermediate expenditure: By definition, the method includes only final expenditures, i.e. expenditures on consumption and investment. Like in the value-added method, the inclusion of intermediate expenditures like that on raw materials, etc, will mean double counting.

- Do not include expenditure on second-hand goods and financial assets: Buying second-hand goods is not a fresh production activity. Buying financial assets is not a production activity because financial assets are neither goods nor services. Therefore they should not be included in estimates of national income.

- Include the self-use of own-produced final products: For example, a house owner using the house for himself. Although explicitly he does not incur any expenditure, implicitly he is making payment of rent to himself. Since the house is producing a service, the imputed value of this service must be included in national income.

- Avoid transfer expenditures: A transfer payment is a payment against which no services are rendered. Therefore no production takes place. Since no production takes place it has no place in national income. Charities, donations, gifts, scholarships, etc. are some examples.

National Product and Other Aggregates

First, let us note that out of NI (NNPfc), which is earned by the firms and government enterprises, a part of the profit is not distributed among the factors of production. This is called Undistributed Profits (UP). We have to deduct UP from NI to arrive at PI since UP does not accrue to households. Similarly, Corporate Tax, which is imposed on the earnings made by the firms, will also have to be deducted from the NI, since it does not accrue to the households. On the other hand, the households do receive interest payments from private firms or the government on past loans advanced by them. And households may have to pay interest to the firms and the government as well, in case they had borrowed money from either. So, we have to deduct the net interest paid by the households to the firms and government. The households receive transfer payments from the government and firms (pensions, scholarships, prizes, for example) which have to be added to calculate the Personal Income of the households.

| Personal Income (PI) = NI – Undistributed profits – Corporate tax – Net interest payments made by households + Transfer payments to the households from the government and firms. |

However, even PI is not the income over which the households have a complete say. They have to pay taxes from PI. If we deduct the Personal Tax Payments (income tax, for example) and Non-tax Payments (such as fines) from PI, we obtain what is known as Personal Disposable Income.

| Personal Disposable Income (PDI ) = PI – Personal tax payments – Non-tax payments. |

Personal Disposable Income is the part of the aggregate income which belongs to the households. They may decide to consume a part of it and save the rest.

| National Disposable Income = Net National Product at market prices + Other current transfers from the rest of the world |

The idea behind National Disposable Income is that it gives an idea of what is the maximum amount of goods and services the domestic economy has at its disposal. Current transfers from the rest of the world include items such as gifts, aids, etc.

| Private Income = Factor income from net domestic product (NDPfc) accruing to the private sector + National debt interest + Net factor income from abroad + Current transfers from government + Other net transfers from the rest of the world. {see the note below} |

Note:

- The sum of net value added by all the production units in the domestic territory is net domestic product of factor cost (NDPfc). All the income generated in a year is not received by consumer households. Income from property and entrepreneurship accruing to the departmental commercial enterprise of the government is retained by the government. Secondly, non-departmental enterprises of the government save a part of their profits for future expansion. This sum also is not available for distribution. It these two sums are deducted from NDPfc, we get income from domestic product or NDPfc accruing to the private sector.

- Income from domestic product accruing to the private sector = NDPfc – income from property and entrepreneurship accruing to the government administration department - savings of non-departmental enterprises.

- 'National debt interest’ is the interest paid by the government on loans taken to meet its administrative expenditure, a consumption expenditure. Since interest on loans taken to meet consumption expenditure is not a factor income it was not included in NDPfc. But since it is a disposable income it is added to NDPfc to arrive at disposable income of the private sector, called Private Income.

Remember this Formula Chart for solving Numerical Problems:

| NDPfc |

| (-) Income from Property and Entrepreneurship accruing to the government administrative departments (-) Saving of non-departmental enterprises |

| = NDPfc accruing to the private sector (+) Net factor income from abroad (+) National debt interest (+) Current transfers from the government administrative departments (+) Net current transfers from the rest of the world |

| = Private Income (-) Saving of private corporate sector (net of retained earnings of foreign companies) (-) Corporation tax |

| = Personal Income (-) Direct taxes paid by households (-) Miscellaneous receipts of government administrative departments. |

| = Personal Disposable Income |

Basic National Income Aggregates

| 1. Gross Domestic Product at Market Prices (GDPMP) | i. GDP is the market value of all final goods and services produced within a domestic territory of a country measured in a year. ii. All production done by the national residents or the non-residents in a country gets included, regardless of whether that production is owned by a local company or a foreign entity. |

| 2. GDP at Factor Cost (GDPFC) | GDPFC = GDPMP - NIT |

| 3. Net Domestic Product at Market Prices (NDPMP) | NDPMP = GDPMP - Depreciation |

| 4. NDP at Factor Cost (NDPFC) or Domestic Income | NDPFC = NDPMP - NIT |

| 5. Gross National Product at Market Prices (GNPMP) | GNPMP = GDPMP - NFIA |

| 6. GNP at Factor Cost (GNPFC) | GNPFC = GNPMP - NIT |

| 7. Net National Product at Market Prices (NNPMP) | NNPMP = GNPMP - Depreciation |

| 8. NNP at Factor Cost (NNPFC) Or National Income (NI) | NI = NDPFC + NFIA |

Nominal and Real GDP

| Real GDP (GDP at constant prices) | Nominal GDP (GDP at current prices) |

| 1. When GDP is measured at constant prices or the base year’s prices, it is known as Real GDP. | 1. When GDP is measured at the prevailing or the current year’s prices, it is known as Nominal GDP. |

| 2. It will only increase when there is an increase in the flow of goods and services in the economy. | 2. It may increase even if there is no increase in the flow of goods and services in the economy. |

GDP Deflator: It is the ratio of nominal GDP to real GDP.

GDP Deflator = ( Nominal GDP/Real GDP x 100) %

Consumer Price Index (CPI): We calculate the cost of purchase of a given basket of commodities in the base year. We also calculate the cost of purchase of the same basket in the current year. Then we express the latter as a percentage of the former. This gives us the Consumer Price Index of the current year vis-´a-vis the base year.

Wholesale Price Index (WPI): It is worth noting that many commodities have two sets of prices. One is the retail price that the consumer actually pays. The other is the wholesale price, the price at which goods are traded in bulk. These two may differ in value because of the margin kept by traders. Goods that are traded in bulk (such as raw materials or semi-finished goods) are not purchased by ordinary consumers. Like CPI, the index for wholesale prices is called Wholesale Price Index (WPI). In countries like USA, it is referred to as Producer Price Index (PPI).

| Consumer Price Index or Wholesale Price Index | GDP Deflator |

| 1. The goods purchased by consumers do not represent all the goods which are produced in a country. | 1. GDP deflator takes into account all such goods and services. |

| 2. CPI includes prices of goods consumed by the representative consumer, hence it includes prices of imported goods. | 2. GDP deflator does not include prices of imported goods. |

| 3. The weights are constant in CPI. | 3. The weights differ according to the production level of each good in the GDP deflator. |

GDP and Welfare

If a person has more income he or she can buy more goods and services and his or her material well-being improves. So it may seem reasonable to treat his or her income level as his or her level of well-being.

But there are at least three reasons why this may not be correct:

- Distribution of GDP – how uniform is it: If the GDP of the country is rising, the welfare may not rise as a consequence. This is because the rise in GDP may be concentrated in the hands of very few individuals or firms. For the rest, the income may in fact have fallen. In such a case the welfare of the entire country cannot be said to have increased.

- Non-monetary exchanges: Many activities in an economy are not evaluated in monetary terms. For example, the domestic services women perform at home are not paid for. In barter exchanges, goods (or services) are directly exchanged against each other. But since money is not being used here, these exchanges are not registered as part of economic activity. In developing countries, where many remote regions are underdeveloped, these kinds of exchanges do take place, but they are generally not counted in the GDPs of these countries. This is a case of underestimation of GDP. Hence, GDP calculated in a standard manner may not give us a clear indication of the productive activity and well-being of a country.

- Externalities: Externalities refer to the benefits (or harms) a firm or an individual causes to another for which they are not paid (or penalized). For example, let us suppose there is an oil refinery that refines crude petroleum and sells it in the market. The output of the refinery is the amount of oil it refines. We can estimate the value added by the refinery by deducting the value of intermediate goods used by the refinery (crude oil in this case) from the value of its output. The value added by the refinery will be counted as part of the GDP of the economy. But in carrying out the production the refinery may also be polluting the nearby river. This may cause harm to the people who use the water of the river. Hence their well-being will fall. Pollution may also kill fish or other organisms of the river on which fish survive. As a result, the fishermen of the river may be losing their livelihood. In this case, the GDP is not taking into account such negative externalities. Therefore, if we take GDP as a measure of the welfare of the economy we shall be overestimating the actual welfare. This was an example of a negative externality. There can be cases of positive externalities as well. In such cases, GDP will underestimate the actual welfare of the economy.

Frequently Asked Questions

What is National Income Accounting?

National Income Accounting is the process of measuring the total economic output of a country over a specific period of time. It is used to evaluate the economic performance of a country and to make comparisons between countries.

What are the components of National Income?

The components of National Income include compensation of employees, gross operating surplus, taxes on production and imports, and net property income from abroad.

What is Gross Domestic Product (GDP)?

Gross Domestic Product (GDP) is the total value of all goods and services produced within a country's borders in a specific period of time. It is one of the most widely used indicators of a country's economic performance.

What is Gross National Product (GNP)?

Gross National Product (GNP) is the total value of all goods and services produced by a country's residents, regardless of where they are located in the world. It includes income earned by citizens working abroad and excludes income earned by foreigners within the country.

What is the difference between GDP and GNP?

The main difference between GDP and GNP is that GDP only considers the economic activity within a country's borders, while GNP includes economic activity by a country's citizens, regardless of where it occurs.

Why is National Income Accounting important?

National Income Accounting is important because it provides a framework for analyzing the economic performance of a country and making comparisons between countries. It helps policymakers to identify areas where economic growth can be encouraged and to assess the impact of economic policies.

What is the difference between nominal GDP and real GDP?

Nominal GDP is the total value of goods and services produced in a country using current market prices, while real GDP is the total value of goods and services produced in a country adjusted for inflation. Real GDP is considered a more accurate measure of a country's economic growth over time.

How is net domestic product (NDP) calculated?

Net domestic product (NDP) is calculated by subtracting the depreciation of capital goods from the gross domestic product (GDP).

| Also See: Class 12 Important Questions |

Hope you liked these notes on Class 12 Economics National Income and Related Aggregates. Please share this with your friends and do comment if you have any doubts/suggestions to share.